You can better understand Revenue Recognition by understanding the data modeling-see the following descriptions of how Revenue Recognition handles common Stripe resources. Total loss due to destination charge refund, and the transfer reversal will reverse the ConnectTransferLoss account. Total loss due to foreign currency exchange rates. If you win the dispute and 120 USD is returned to you, 20 USD is reflected as revenue and the remaining 100 USD is reflected as recoverables. For example, if you have a 120 USD dispute on an annual subscription during the second month, 20 USD for the first 2 months is contra revenue and the remaining 100 USD is adjusted from the deferred revenue balance.

Recovered funds that aren’t attributable to revenue.

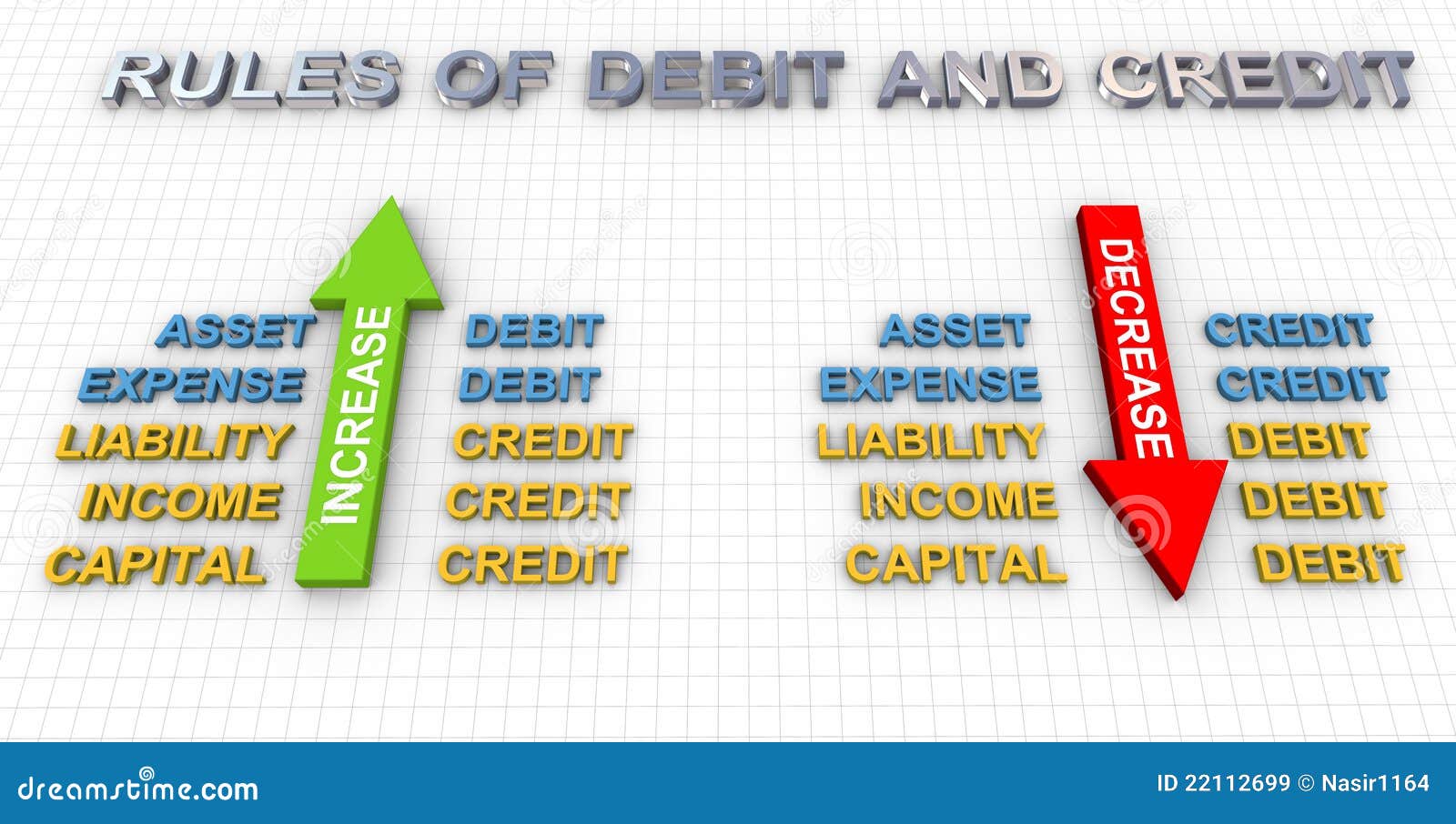

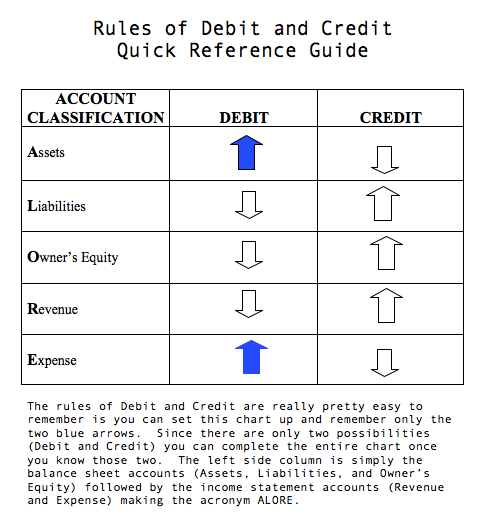

#DEBIT CREDIT RULES CHART MANUAL#

Previously recognized revenue from separate transfers.Įxpenses incurred due to manual adjustments to a customer credit balance.Įxpenses incurred due to transfers that underpay an invoice, as used by the customer credit balance payment method or Sources. These items are sometimes deleted when they generate unbilled accounts receivable and revenue. Previously recognized revenue from prorated invoice items that have been deleted. Previously recognized revenue from invoices that have been voided. Previously recognized revenue from invoices that have been marked as uncollectible. The remaining 100 USD is adjusted and reflected in your deferred revenue balance in the balance sheet. For example, if there’s a 120 USD credit note on an annual subscription during the second month, 20 USD for the first 2 months is contra revenue. Portion of the credit note amount previously recognized. For example, if there’s a 120 USD dispute on an annual subscription during the second month, 20 USD for the first 2 months is contra revenue. Portion of the disputed amount previously recognized. For example, if you issue a 120 USD refund on an annual subscription during the second month, 20 USD for the first 2 months is contra revenue. Portion of the refunded amount previously recognized. For example, if an invoice line item is for 90 USD with 10 USD in taxes, the total invoice is 100 USD, but the recognizable portion is only 90 USD.

Recognizable portion of finalized invoices, prorated invoice items, and metered billing that count towards revenue during the month.

0 kommentar(er)

0 kommentar(er)